The price of silver from 1921 to 2021 is quite the rollercoaster ride!

In 1921 the price of silver was around sixty-three cents per troy ounce. By 1932 the price had fallen to twenty-eight cents per ounce. Then the price moved up and down for decades but trended up and finally broke over one dollar per ounce around 1960. Next, it traded around one to two dollars for almost 15 years until the infamous Hunt brothers came along and cornered the silver market.

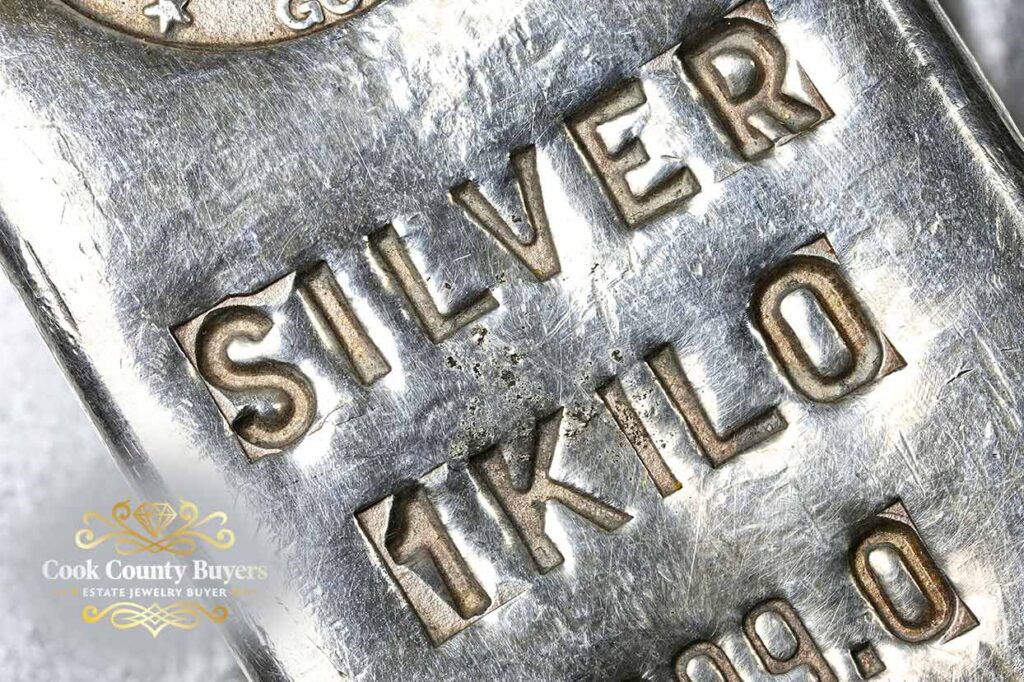

Physical Silver

The Hunt brothers were sons of a wealthy oil tycoon who died in 1974 and left billions of dollars to his family. Herbert and Nelson Hunt took their part of the fortune and bought physical silver and silver futures contracts. But unlike most futures contract buyers who would usually close their position in cash, the Hunts demanded delivery of physical silver. The Hunt brothers believed that inflation would result in silver becoming a haven much like gold and expected a tenfold increase in the price of silver.

Through their continued practice of buying as much physical silver and removing it from the market, they managed to drive the price of silver up to nearly $50 per troy ounce by March of 1980. However, the government became aware of their market manipulation and intervened, causing the price to plummet back down to $11 almost immediately.

Will Silver Hit$50?

Through the mid-1980s, silver remained under $10 per ounce. In 1992 silver hit a meager price of only $3.75 per ounce! It wasn’t until 2006 that silver finally managed to eek its way back above $10 per ounce. Since then, silver has seen some ups and downs, with a peak price of $48.60 in April of 2011. However, by 2014 the price once again had fallen to under $15 per ounce. And now silver is moving upward again and trending in the $20 to $30 per ounce range.

No one knows if or when silver will break above $50 per ounce and stay there. Silver bugs have been forecasting $100 per ounce silver for decades, yet it never seems to happen. We know that silver prices tend to move up and down with gold prices, and gold has seen some new all-time highs in the last couple of years, breaking over $2000 per ounce at one point.

With all the money printing in 2020 and 2021, inflation will likely occur, and the dollar will lose strength, hence pushing precious metals higher than we’ve ever seen before. As I examined the last 100 years of price activity, there have been several substantial price spikes and major crashes, as well as decade periods of relatively little movement.

But as always, only time will tell. So when is the right time to sell your silver? Who the hell knows!

Additional reading

Visit Cook Count Silver Buyer for more information on Silver or learn more about the author, Mike J. If you have decided now is the time to sell, please call or text me at (773) 490-9828 to schedule a meeting or to get a valuation.

Learn more about Buying or Selling Gold at an all-time high here Gold at Gold Prices at all-time High

And let’s not forget about platinum, which used to be considered one of the most precious metals, but now trades below gold prices! Read about it here: Learn more about Buying and Selling Platinum at Platinum Price Craziness